When it comes to renewing your car insurance, taking the time to shop around for quotes can lead to significant savings. In this article, we'll delve into the importance of comparing quotes, key factors to consider, money-saving tips, and online tools to streamline the process.

Let's explore how being proactive with your car insurance renewal can benefit your wallet.

Importance of Shopping Car Insurance Quotes Before Renewal

When it comes to renewing your car insurance, taking the time to shop around for quotes can make a significant impact on your finances and coverage. Here's why it's essential to compare car insurance quotes before deciding to renew:

Potential Cost Savings

By exploring different insurance providers and their offerings, you may uncover better deals and discounts that could result in substantial cost savings compared to simply renewing with your current provider. These savings can add up over time, allowing you to allocate your resources more effectively.

Policy and Rate Changes

Insurance policies and rates are subject to change over time, influenced by factors such as market trends, your driving record, and the insurance company's business decisions. As a result, what was a competitive rate when you initially signed up may no longer be the best option for you.

Shopping around enables you to stay informed about the current offerings in the market and make an informed decision based on your needs and budget.

Factors to Consider When Shopping for Car Insurance Quotes

When shopping for car insurance quotes, there are several key factors to consider that can impact the coverage you receive and the premiums you pay. It's important to carefully review and compare these factors to make an informed decision that meets your needs and budget.

Coverage Limits, Deductibles, and Add-Ons

- When comparing quotes, pay close attention to the coverage limits for liability, collision, and comprehensive insurance. Make sure the limits are sufficient to protect you in case of an accident or other unforeseen events.

- Consider the deductibles for each type of coverage. A higher deductible can lower your premium but may result in higher out-of-pocket expenses if you need to file a claim.

- Review any add-on options offered by the insurance providers, such as roadside assistance, rental car coverage, or gap insurance. Assess whether these add-ons are necessary for your situation.

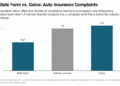

Reviewing Customer Reviews and Ratings

- Before selecting an insurance provider, take the time to read customer reviews and ratings. Feedback from current or past policyholders can provide valuable insights into the company's customer service, claims process, and overall satisfaction.

- Look for trends in reviews, both positive and negative, to gauge the reputation and reliability of the insurance provider. Choose a company that has a track record of responsive and fair treatment of customers.

Personal Driving History and Location

- Your personal driving history, including any accidents or traffic violations, can significantly impact the insurance rates you are quoted. Be prepared to provide accurate information about your driving record when requesting quotes.

- Location also plays a role in determining insurance rates. Urban areas with higher rates of car theft or accidents may result in higher premiums. Consider how your location affects your risk profile and potential insurance costs.

Tips for Saving Money When Renewing Car Insurance

When it comes time to renew your car insurance, there are several strategies you can use to potentially save money on your premiums. By being proactive and taking advantage of available discounts, you can negotiate a better rate with your current insurance provider.

Here are some tips to help you save money when renewing your car insurance:

Negotiate with Your Current Insurance Provider

When your policy is up for renewal, don't be afraid to negotiate with your current insurance provider for a better rate. You can mention any changes in your driving habits or improvements in your credit score to potentially qualify for a lower premium.

Leverage Discounts and Bundle Policies

Take advantage of any discounts offered by your insurance company, such as safe driver discounts, multi-policy discounts, or discounts for paying your premium in full

. Bundling your car insurance with other policies, like home or renters insurance, can also lead to significant savings.

Adjust Your Coverage

Consider adjusting your coverage levels to better suit your current needs. If you have an older car, you may not need comprehensive or collision coverage, which can lower your premium. However, make sure you maintain the coverage required by law in your state.

Improve Your Credit Score and Driving Habits

Improving your credit score and maintaining a clean driving record can have a positive impact on your insurance premiums. Insurance companies often use credit scores and driving history to determine rates, so focusing on improving these areas can help you save money on your car insurance.

Online Tools and Resources for Comparing Car Insurance Quotes

When it comes to comparing car insurance quotes, utilizing online tools and resources can make the process much easier and efficient. These platforms provide a wealth of information and options to help you find the best coverage at a competitive price.

Popular Websites for Comparing Car Insurance Quotes

- Insurance Comparison Websites: Websites like Compare.com, The Zebra, and Gabi allow you to compare quotes from multiple insurers in one place, saving you time and effort.

- Insurance Company Websites: Many insurance companies offer online quote tools on their websites, allowing you to get personalized quotes based on your information.

Benefits of Using Online Calculators

- Estimate Premiums: Online calculators use your personal information to estimate insurance premiums, helping you understand the cost of coverage based on your specific factors.

- Compare Options: By inputting different details and coverage levels, you can easily compare quotes from various insurers to find the best fit for your needs.

Tips for Effective Use of Online Tools

- Provide Accurate Information: Make sure to input accurate details about your driving history, vehicle, and coverage preferences to receive the most accurate quotes.

- Compare Apples to Apples: When comparing quotes, ensure that the coverage levels and deductibles are similar across different insurers for a fair comparison.

- Review Coverage Details: Take the time to review the coverage details and policy terms offered by each insurer to make an informed decision about the best option for you.

Wrap-Up

In conclusion, by shopping car insurance quotes before renewal, you can make informed decisions that not only save you money but also ensure you have the right coverage for your needs. Don't miss out on potential savings – start comparing quotes today and take control of your car insurance expenses.

Helpful Answers

Why is it important to shop car insurance quotes before renewal?

Comparing quotes allows you to potentially find better rates and coverage options that suit your needs.

What factors should I consider when shopping for car insurance quotes?

Key factors include coverage limits, deductibles, add-ons, customer reviews, driving history, and location.

How can I save money when renewing car insurance?

You can negotiate for better rates, leverage discounts, bundle policies, adjust coverage, improve credit score, and driving habits.

What online tools can help in comparing car insurance quotes?

Popular websites and tools offer easy comparison, online calculators estimate premiums, and tips for finding competitive prices.