Delve into the world of Geico Commercial Auto Insurance vs State Farm Comparison to uncover the differences and similarities between these two major players in the insurance industry. As we explore their offerings, pricing, customer service, and more, you'll gain valuable insights to help you make an informed decision for your commercial auto insurance needs.

Overview of Geico Commercial Auto Insurance and State Farm

Geico Commercial Auto Insurance offers coverage for businesses that use vehicles for work purposes. They provide a range of policies tailored to different business needs, including liability, comprehensive, and collision coverage.State Farm also provides commercial auto insurance for businesses of all sizes.

Their offerings include coverage for bodily injury, property damage, and medical payments. State Farm is known for its personalized service and a wide network of agents across the country.

Comparison of Reputation in the Insurance Industry

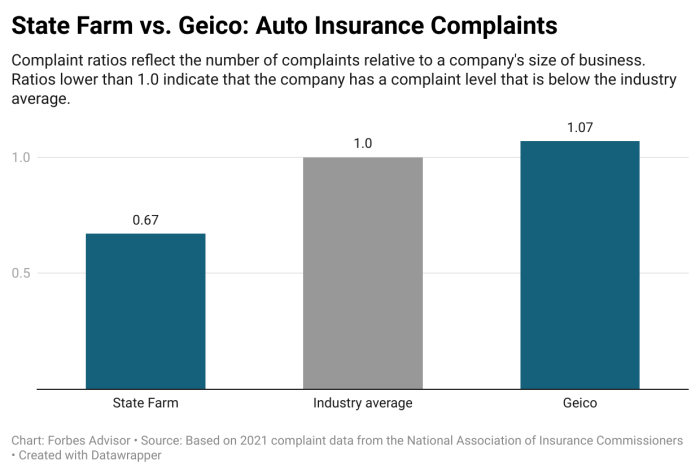

Both Geico and State Farm have solid reputations in the insurance industry. Geico is known for its competitive rates and user-friendly online tools, making it a popular choice for many business owners. On the other hand, State Farm is praised for its excellent customer service and reliable claims handling, which has earned them a loyal customer base over the years.

Coverage Options and Limits

When it comes to commercial auto insurance, the coverage options and limits offered by Geico and State Farm can play a crucial role in determining the level of protection for your business vehicles.

Geico Commercial Auto Insurance Coverage Options

Geico offers a range of coverage options for commercial auto insurance, including:

- Liability coverage: Protects your business from financial losses due to bodily injury or property damage caused by your vehicles.

- Collision coverage: Covers the cost of repairing or replacing your vehicle after an accident.

- Comprehensive coverage: Provides protection against non-collision incidents like theft, vandalism, or natural disasters.

- Medical payments coverage: Helps pay for medical expenses for you and your passengers in case of an accident.

- Uninsured/underinsured motorist coverage: Covers damages if you're involved in an accident with a driver who has inadequate insurance.

State Farm Commercial Auto Insurance Coverage Options

State Farm also offers a variety of coverage options for commercial auto insurance, such as:

- Liability coverage: Protects your business in case you're at fault for an accident that causes bodily injury or property damage.

- Collision coverage: Covers the cost of repairing or replacing your vehicle after a collision with another vehicle or object.

- Comprehensive coverage: Provides protection for non-collision incidents like theft, vandalism, or weather damage.

- Medical payments coverage: Helps cover medical expenses for you and your passengers if injured in an accident.

- Personal injury protection (PIP): Covers medical expenses, lost wages, and other expenses regardless of fault.

Comparison of Coverage Limits and Unique Offerings

Both Geico and State Farm offer varying coverage limits depending on the policy and state regulations. Geico is known for its competitive rates and user-friendly online tools, while State Farm is recognized for its personalized service and local agents who can help tailor coverage to your specific needs.

Additionally, State Farm offers unique features like rideshare insurance for drivers working for companies like Uber or Lyft.

Pricing and Discounts

When it comes to commercial auto insurance, pricing and discounts play a significant role in determining the overall cost of coverage. Let's take a closer look at how Geico and State Farm handle pricing and discounts for their commercial auto insurance policies.

Geico Commercial Auto Insurance Pricing

Geico determines pricing for its commercial auto insurance policies based on a variety of factors, including the type of vehicles being insured, the driving records of the drivers, the coverage limits selected, and the location of the business. Additionally, Geico may take into account the number of vehicles insured, the purpose of use (business or personal), and any previous claims history.

State Farm Commercial Auto Insurance Pricing

Similarly, State Farm considers several factors when determining the pricing for its commercial auto insurance policies. These factors include the type of vehicles, the driving records of the drivers, the coverage options chosen, and the location of the business. State Farm may also take into account the number of years the business has been in operation, the number of vehicles insured, and any previous claims history.

Discounts Offered by Geico and State Farm

Both Geico and State Farm offer various discounts that can help businesses save on their commercial auto insurance premiums. Geico may offer discounts for having multiple policies with them, having a clean driving record, using anti-theft devices, or completing a defensive driving course.

On the other hand, State Farm may provide discounts for bundling policies, having a good claims history, using telematics devices, or being a member of certain organizations.Overall, the pricing and discounts offered by Geico and State Farm can vary based on individual circumstances and business needs.

It's essential for businesses to compare quotes from both insurers to find the best coverage at the most competitive price.

Customer Service and Claims Process

When it comes to commercial auto insurance, customer service and claims process efficiency are crucial aspects to consider. Let's take a closer look at how Geico and State Farm compare in these areas.

Geico Commercial Auto Insurance Customer Service

Geico is known for its convenient customer service options, including a user-friendly website and a mobile app for policy management. Customers can easily reach Geico representatives through their 24/7 customer service hotline for any queries or assistance. The company has received positive feedback for its responsive customer support team.

State Farm Commercial Auto Insurance Customer Service

State Farm also offers a variety of customer service channels, such as phone support, online chat, and in-person assistance through local agents. Customers appreciate the personalized service provided by State Farm agents, who can guide them through the insurance process and address any concerns effectively.

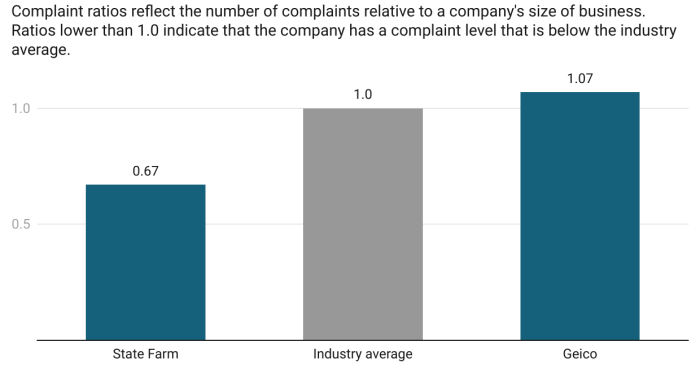

Claims Process Efficiency and Customer Satisfaction

Both Geico and State Farm are known for their efficient claims processes, aiming to make the experience as smooth as possible for their policyholders. Geico's online claims reporting system allows customers to file claims quickly and easily, while State Farm's network of agents can assist with the claims process in person.

Customer satisfaction ratings for both companies indicate that policyholders are generally pleased with the handling of their claims.

Final Wrap-Up

In conclusion, the comparison between Geico Commercial Auto Insurance and State Farm highlights key aspects to consider when choosing the right insurance provider for your commercial vehicles. Whether it's coverage options, pricing, or customer service, understanding these differences can lead to a well-informed decision that suits your specific requirements.

FAQ Insights

What factors should I consider when choosing between Geico and State Farm for commercial auto insurance?

Consider factors such as coverage options, pricing, discounts, and customer service to make an informed decision based on your specific needs.

Do Geico and State Farm offer similar coverage options for commercial auto insurance?

While both companies offer standard coverage options, they may have unique offerings or limits, so it's essential to compare them to find the best fit for your business.

How do I file a claim with Geico or State Farm for commercial auto insurance?

The claims process for both companies involves contacting their respective claims departments and providing necessary information to initiate the claim process.