Exploring the world of auto policy quotes customization opens up a realm of possibilities tailored to individual needs. This guide delves into the intricate details of crafting the perfect policy quotes to suit your unique requirements.

Understanding Auto Policy Quotes

Auto policy quotes are estimates provided by insurance companies that Artikel the cost of coverage for your vehicle. These quotes are based on various factors and help individuals understand the financial implications of different insurance options.

Factors Influencing Auto Policy Quotes

- Your driving record, including any past accidents or traffic violations.

- The type of vehicle you drive, as some cars are more expensive to insure than others.

- Your age and experience as a driver, with younger or inexperienced drivers often facing higher premiums.

- The coverage options you choose, such as liability, comprehensive, or collision coverage.

- The location where you live, as insurance rates can vary based on factors like crime rates and traffic congestion.

Importance of Customizing Auto Policy Quotes

Customizing auto policy quotes is crucial to ensure that you are getting the coverage you need at a price that fits your budget. By tailoring your policy to your specific needs, you can avoid paying for unnecessary coverage while ensuring you have adequate protection in case of an accident or other unforeseen events.

Factors to Consider for Customization

When customizing your auto policy quotes, there are several key factors to consider to ensure you have the right coverage for your needs. These factors include coverage limits, deductibles, additional coverage options, personal information, driving history, location, vehicle type, usage, and safety features.

Coverage Limits, Deductibles, and Additional Coverage Options

- When customizing your auto policy, it's important to determine the coverage limits for liability, collision, and comprehensive coverage. Higher coverage limits provide more protection but may come with higher premiums.

- Deductibles are the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premium, but you'll have to pay more in the event of a claim.

- Additional coverage options such as roadside assistance, rental car reimbursement, and gap insurance can provide extra protection but will also impact your premium.

Personal Information and Driving History

- Your personal information, such as age, gender, and marital status, can affect your insurance rates. Younger drivers and single individuals may pay higher premiums.

- Your driving history, including accidents, tickets, and claims, will also impact your rates. A clean driving record can result in lower premiums.

- Your location, including where you live and where you park your car, can affect your insurance rates. Urban areas and areas with high crime rates may result in higher premiums.

Vehicle Type, Usage, and Safety Features

- The type of vehicle you drive, such as a sedan, SUV, or sports car, will affect your insurance rates. More expensive or powerful vehicles may result in higher premiums.

- How you use your vehicle, whether for commuting, business, or pleasure, will also impact your rates. Increased mileage or business use can lead to higher premiums.

- Safety features such as anti-theft devices, airbags, and anti-lock brakes can lower your insurance rates. Make sure to inform your insurer of any safety features your vehicle has.

Customizing Coverage Limits and Deductibles

When customizing your auto insurance policy, it's essential to consider adjusting both coverage limits and deductibles to meet your specific needs. Coverage limits refer to the maximum amount your insurance company will pay for a covered claim, while deductibles are the amount you must pay out of pocket before your insurance coverage kicks in.

Differences between Coverage Limits and Deductibles

- Coverage Limits: Set the maximum amount your insurance will pay for a claim.

- Deductibles: Amount you must pay out of pocket before insurance coverage starts.

Adjusting Coverage Limits and Premiums

- Increasing coverage limits typically result in higher premiums but offer more financial protection in case of an accident.

- Decreasing coverage limits can lower premiums but may leave you financially vulnerable if the damages exceed your coverage.

- For example, raising your liability coverage from the state minimum to a higher limit can increase premiums but provide better protection in the event of a severe accident.

Choosing Deductibles Based on Risk Tolerance

- Higher deductibles usually lead to lower premiums since you are taking on more of the financial risk.

- Lower deductibles mean higher premiums but less out-of-pocket expenses in case of a claim.

- Consider your risk tolerance and ability to pay the deductible when choosing between high and low deductibles.

Selecting Additional Coverage Options

Adding additional coverage options to your auto policy can provide extra protection and peace of mind. These options can enhance your policy to meet specific needs and ensure you are adequately covered in various scenarios.

Roadside Assistance

Roadside assistance is a common additional coverage option that can be invaluable in case of a breakdown or emergency while on the road. This coverage typically includes services such as towing, battery jump-start, flat tire assistance, and fuel delivery.

Rental Car Reimbursement

Rental car reimbursement is another useful option to consider. If your car is in the shop for repairs after an accident, this coverage can help cover the cost of renting a vehicle while yours is being repaired.

Scenarios Where Additional Coverage Options Are Beneficial

- For frequent travelers who may encounter breakdowns or emergencies on the road

- For individuals who heavily rely on their vehicle for daily commuting or work

- For those who want added peace of mind knowing they have extra support in case of unforeseen events

Utilizing Discounts and Bundling Options

When customizing auto policy quotes, it's essential to take advantage of discounts and bundling options to maximize savings on your insurance premiums.

Identifying Potential Discounts

- Safe Driver Discounts: Insurance companies often offer discounts to policyholders who have a clean driving record with no accidents or traffic violations.

- Multi-Policy Discounts: Combining your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant cost savings.

Exploring Bundling Options

- Bundling auto insurance with other policies from the same insurance provider can result in discounts on both policies.

- Consider bundling your auto insurance with other family members' policies to increase savings even further.

Strategies for Maximizing Discounts

- Compare quotes from different insurance companies to see which one offers the best discounts for your specific needs.

- Ask your insurance agent about any available discounts that you may qualify for based on your driving history or policy preferences.

- Review your policy regularly to ensure you are taking advantage of all available discounts and bundling options.

Reviewing and Comparing Customized Quotes

When customizing auto policy quotes, it is crucial to review the policy details carefully before finalizing any decisions. This step ensures that you understand the coverage options, limits, deductibles, and any additional features included in the quote. By reviewing the policy details, you can make an informed decision that meets your specific needs and preferences.

The Importance of Reviewing Policy Details

- Check coverage limits: Ensure that the coverage limits offered in the quote align with your needs and provide adequate protection in case of an accident.

- Review deductibles: Evaluate the deductibles for comprehensive and collision coverage to determine the out-of-pocket expenses you would incur in the event of a claim.

- Examine additional coverage options: Understand the additional coverage options included in the quote, such as roadside assistance or rental car reimbursement, and assess their value to you.

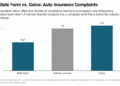

Tips for Comparing Quotes

- Request quotes from multiple insurance providers to compare coverage options, limits, and premiums.

- Consider the reputation and financial stability of the insurance companies when evaluating quotes.

- Review customer reviews and ratings to gauge the quality of service provided by each insurer.

Balancing Cost with Coverage

- While it is essential to consider the cost of the auto policy, it is equally important to prioritize adequate coverage to protect yourself financially in case of an accident.

- Compare quotes based on the value they offer in terms of coverage, customer service, and overall benefits, rather than solely focusing on the premium amount.

- Seek a balance between affordability and sufficient coverage to ensure you are adequately protected without overpaying for unnecessary features.

Last Point

In conclusion, customizing auto policy quotes is a crucial step in securing the ideal coverage that aligns with your specific needs. By understanding the factors, options, and strategies involved, you can navigate the insurance landscape with confidence and clarity.

Essential Questionnaire

What are auto policy quotes?

Auto policy quotes are estimates provided by insurance companies that detail the cost and coverage of an insurance policy for your vehicle.

How do personal factors influence auto policy quotes?

Personal factors like driving history, location, and age can affect the quotes you receive as they reflect your risk profile to insurers.

What are common additional coverage options?

Common additional coverage options include roadside assistance, rental car reimbursement, and gap insurance, among others.

How can I maximize discounts while customizing policy quotes?

You can maximize discounts by bundling policies, maintaining a clean driving record, and exploring all available discounts with your insurer.