When it comes to getting the best deal on car insurance, the key lies in shopping around for quotes. By exploring different options, you can uncover better premium rates that suit your budget and needs. This guide will walk you through the importance of comparing quotes, factors that influence rates, shopping strategies, coverage options, and maximizing discounts to help you secure the best possible deal.

In the world of car insurance, finding the right policy at the right price can make a significant difference in your financial well-being. Let's dive into the details of how you can save money and get better premium rates by shopping car insurance quotes.

Importance of Shopping Car Insurance Quotes

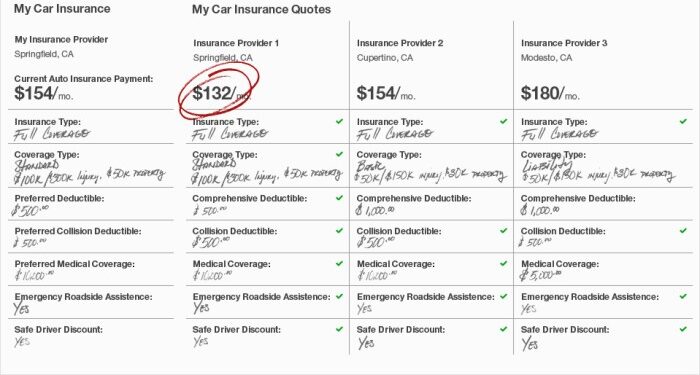

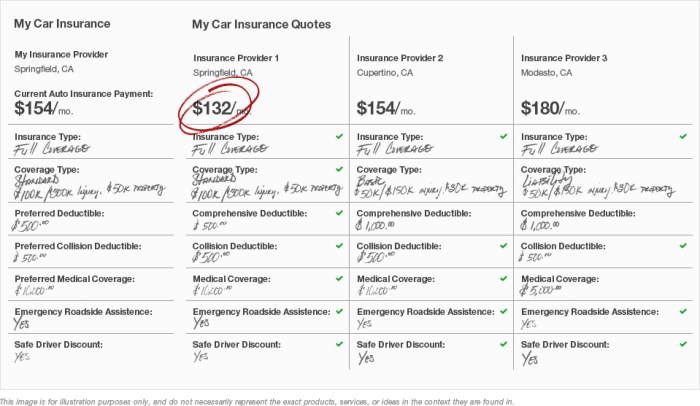

When it comes to car insurance, shopping around for quotes is essential to finding the best coverage at the most competitive rates. By comparing quotes from different insurance providers, you can make an informed decision and potentially save money on your premiums.

Obtaining Better Premium Rates

Comparing car insurance quotes allows you to see the varying rates and coverage options available in the market. This process helps you identify the most cost-effective policy that meets your needs without compromising on coverage. Insurers consider different factors when calculating premiums, so exploring multiple options gives you the opportunity to find the best deal.

Factors Influencing Premium Rates

When it comes to car insurance, several factors can influence the premium rates you are quoted. Understanding these factors can help you navigate the process of getting better rates.

Personal Details

- Your age, gender, marital status, and occupation can all impact the premium rates you are quoted.

- Insurance companies use statistical data to assess risk, so certain demographics may be charged higher rates.

- Younger, unmarried drivers often face higher premiums due to a perceived higher risk of accidents.

Driving History

- Your driving record, including any past accidents or traffic violations, plays a significant role in determining your premium rates.

- Drivers with a history of accidents or violations are considered higher risk and may face higher premiums.

- Maintaining a clean driving record can help lower your premium rates over time.

Type of Vehicle

- The make, model, age, and safety features of your vehicle can impact the cost of your insurance.

- Newer, more expensive cars may cost more to insure due to higher repair or replacement costs.

- Vehicles with advanced safety features may qualify for discounts on insurance premiums.

Shopping Strategies for Better Rates

When it comes to shopping for car insurance quotes, there are various strategies you can employ to secure better premium rates. By being proactive and informed, you can increase your chances of finding a policy that fits your budget while providing adequate coverage.

Utilize Online Comparison Tools

Online comparison tools can be incredibly helpful in quickly obtaining quotes from multiple insurance providers. These tools allow you to input your information once and receive quotes from various companies, saving you time and effort in the process.

- Enter your details accurately to ensure the quotes you receive are as precise as possible.

- Compare not only the premium rates but also the coverage options and deductibles offered by each provider.

- Consider using reputable comparison websites to ensure the accuracy and reliability of the quotes you receive.

Contact Agents Directly

While online tools are convenient, contacting insurance agents directly can also be beneficial in securing better rates. Agents can provide personalized quotes based on your specific needs and circumstances, potentially offering discounts or incentives that may not be available through online platforms.

- Ask agents about any available discounts or promotions that you may qualify for, such as safe driver discounts or multi-policy discounts.

- Provide agents with information about your driving history and any additional safety features in your vehicle to potentially lower your premium rates.

- Be prepared to negotiate with agents to find a policy that meets your budget without sacrificing necessary coverage.

Understanding Coverage Options

When it comes to car insurance, understanding the different coverage options available is crucial in determining the level of protection you have and how much you pay in premiums.

Liability Coverage

- Provides coverage for injuries and property damage to others in an accident that you are legally responsible for.

- Mandatory in most states and typically split into bodily injury and property damage liability.

Collision Coverage

- Covers the cost of repairs or replacement of your vehicle in the event of a collision with another vehicle or object.

- Helpful if you have a newer car or one with a loan or lease.

Comprehensive Coverage

- Protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters.

- Considered optional but valuable for added protection.

Uninsured/Underinsured Motorist Coverage

- Provides coverage if you are in an accident with a driver who has insufficient or no insurance.

- Important for protecting yourself in case of an accident with an uninsured driver.

Medical Payments Coverage

- Covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

- Useful for covering medical bills that may not be fully covered by health insurance.

Utilizing Discounts and Incentives

When shopping for car insurance, utilizing discounts and incentives can significantly reduce your insurance costs. Insurance companies offer various discounts that can help you save money on your premiums, making it essential to understand these options and how to qualify for them.

Common Discounts Offered by Insurance Companies

- Good Driver Discount: Insurance companies often offer discounts to drivers with a clean driving record, free of accidents or traffic violations.

- Multi-Policy Discount: If you have multiple insurance policies with the same company, such as home and auto insurance, you may qualify for a discount on both.

- Good Student Discount: Students with good grades are often eligible for discounts on their car insurance premiums.

Strategies to Maximize Savings through Discounts

- Bundle Policies: Combining multiple insurance policies with the same company can lead to significant discounts on your overall premiums.

- Ask About Available Discounts: Inquire about all the discounts offered by the insurance company and ensure you are taking advantage of all that apply to you.

- Monitor Your Driving: Maintaining a safe driving record can help you qualify for good driver discounts and other rewards from your insurance provider.

Final Review

In conclusion, shopping car insurance quotes is a smart and proactive way to ensure you're not overpaying for coverage. By taking the time to compare quotes, understand coverage options, and leverage discounts, you can secure a policy that offers the best value for your money.

So, start exploring your options today and make the most of your car insurance budget.

Popular Questions

What are some key benefits of shopping around for car insurance quotes?

Shopping around allows you to compare different rates and coverage options to find the best deal that suits your needs and budget.

How can personal details and driving history impact car insurance premium rates?

Factors like age, driving record, and type of vehicle can influence the cost of insurance premiums, with safer drivers and low-risk vehicles often receiving lower rates.

What are some common discounts offered by insurance companies?

Common discounts include safe driver discounts, multi-policy discounts, and discounts for certain safety features on your vehicle. By qualifying for these discounts, you can lower your insurance costs.