Embark on a journey through the Commercial Auto Policy Renewal Guide for Fleet Owners, exploring the intricacies of policy renewals for fleet owners. From understanding coverage options to navigating the renewal process, this guide provides a comprehensive overview to help fleet owners make informed decisions.

Introduction to Commercial Auto Policy Renewal Guide for Fleet Owners

Commercial auto policy renewal is the process through which fleet owners extend or update their existing insurance coverage for their vehicles used for business purposes. It is a vital aspect of managing a fleet as it ensures that the vehicles are adequately protected against potential risks and liabilities.

Importance of Understanding the Policy Renewal Process

It is essential for fleet owners to have a clear understanding of the policy renewal process to make informed decisions about their insurance coverage. By knowing when and how to renew their policies, fleet owners can avoid gaps in coverage and ensure that their vehicles are always protected.

Benefits of Having a Comprehensive Policy Renewal Guide

- Access to Current Information: A comprehensive policy renewal guide provides fleet owners with up-to-date information on the renewal process, including any changes in regulations or coverage options.

- Cost Savings: By understanding the policy renewal process, fleet owners can identify cost-saving opportunities such as discounts or alternative coverage options that better suit their needs.

- Improved Risk Management: A detailed policy renewal guide can help fleet owners assess their insurance needs more accurately and make informed decisions to mitigate risks effectively.

- Peace of Mind: Knowing the ins and outs of the policy renewal process can give fleet owners peace of mind, knowing that their vehicles and business are adequately protected at all times.

Understanding Commercial Auto Policy Coverage

Commercial auto policies offer a range of coverage options designed to protect fleet owners from various risks and liabilities associated with their vehicles. Understanding these coverage options is essential for fleet owners to ensure they have adequate protection in place.

Liability Coverage

Liability coverage is a fundamental component of any commercial auto policy, as it protects fleet owners from financial losses in the event of an accident where they are found at fault. This coverage helps pay for damages to third parties, including medical expenses and property damage.

For example, if one of your drivers causes an accident that results in injuries to another driver and damage to their vehicle, liability coverage would help cover those costs.

Collision Coverage

Collision coverage is another important type of coverage that helps pay for repairs to your vehicles in the event of a collision, regardless of who is at fault. This coverage is crucial for fleet owners to ensure their vehicles can be quickly repaired and back on the road.

For instance, if one of your vehicles collides with a stationary object, such as a pole or a building, collision coverage would help cover the cost of repairs.

Comprehensive Coverage

Comprehensive coverage provides protection for your vehicles against non-collision incidents, such as theft, vandalism, or weather-related damage. This coverage is valuable for fleet owners looking to safeguard their vehicles from a wide range of risks beyond accidents. For example, if one of your vehicles is stolen or damaged in a hailstorm, comprehensive coverage would help cover the costs of replacement or repairs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is designed to protect fleet owners in the event that one of their vehicles is involved in an accident with a driver who either has no insurance or insufficient insurance to cover the damages. This coverage can help cover medical expenses and property damage for your drivers when the at-fault party is unable to do so.

For instance, if one of your vehicles is hit by an uninsured driver, uninsured/underinsured motorist coverage would step in to cover the costs.

Factors Affecting Policy Renewal Rates

When it comes to renewing commercial auto policies for fleet owners, there are several key factors that can influence the renewal rates. Factors such as fleet size, driving history, and vehicle types play a significant role in determining how much a fleet owner will pay for insurance coverage.

Additionally, different insurance providers may assess these factors differently, leading to variations in renewal rates.

Fleet Size

The size of a fleet can greatly impact policy renewal rates. Generally, larger fleets with more vehicles may face higher premiums due to the increased risk of accidents and claims. Insurance providers may offer discounts for smaller fleets, as they are perceived to be less risky to insure.

Fleet owners with a larger number of vehicles should be prepared to pay higher renewal rates compared to those with smaller fleets.

Driving History

The driving history of a fleet, including any accidents or traffic violations, can also affect policy renewal rates. Fleet owners with a history of accidents or claims may be considered higher risk by insurance providers, resulting in higher premiums at renewal.

On the other hand, fleet owners with a clean driving record may be eligible for lower renewal rates as they are seen as less risky to insure.

Vehicle Types

The types of vehicles in a fleet can impact policy renewal rates as well. Vehicles that are more expensive to repair or replace, such as commercial trucks or specialized vehicles, may lead to higher premiums. Additionally, the age and condition of the vehicles can also play a role in determining renewal rates.

Fleet owners should be aware of how the types of vehicles in their fleet can influence their insurance costs.

Tips for Fleet Owners to Lower Renewal Costs

When it comes to renewing your commercial auto policy as a fleet owner, there are several strategies you can implement to lower your costs and maximize your savings. From bundling insurance policies to negotiating with providers, these tips can help you secure better rates and maintain a cost-effective operation

Bundling Insurance Policies

By bundling your commercial auto policy with other insurance policies, such as general liability or property insurance, you can often receive a discount from your provider. This not only saves you money on each individual policy but also simplifies your insurance management by consolidating all your coverage under one provider.

Implementing Risk Management Practices

Fleet owners can also lower their renewal costs by implementing effective risk management practices. This includes maintaining a safe driving record, providing regular training for drivers, and investing in preventive maintenance for your vehicles. By reducing the likelihood of accidents and claims, insurance providers may offer lower rates as a reward for your proactive risk management.

Negotiating with Insurance Providers

When it comes time to renew your commercial auto policy, don't be afraid to negotiate with your insurance provider for better rates. You can leverage factors such as your fleet's safety record, driver training programs, and loyalty as a long-term customer to potentially secure discounts or lower premiums.

Be prepared to discuss these points with your provider and explore opportunities for cost savings.

Renewal Process Walkthrough

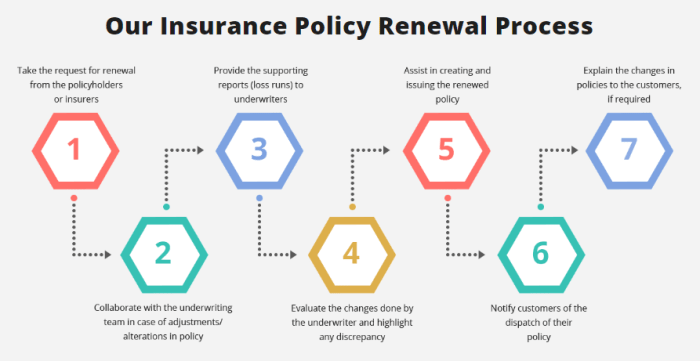

As fleet owners, renewing your commercial auto policy is a crucial task to ensure your vehicles are properly covered. Here is a step-by-step guide to help you navigate through the renewal process smoothly.

Important Deadlines and Documentation Requirements

- Mark your calendar with the policy renewal date to avoid any lapse in coverage.

- Gather all necessary documentation such as vehicle information, driver details, and previous claims history.

- Review and update any changes in your fleet size, vehicles, or drivers to ensure accurate coverage.

Renewal Procedures

- Contact your insurance provider well in advance of the renewal date to start the process.

- Discuss any changes or updates to your policy needs with your agent to tailor the coverage accordingly.

- Review the renewal documents carefully to ensure all information is accurate before signing.

- Make the necessary payment to renew your policy and receive the updated documents.

Common Pitfalls to Avoid

- Avoid waiting until the last minute to start the renewal process, as it may lead to delays or errors.

- Double-check all information provided to avoid discrepancies that could affect your coverage.

- Seek clarification on any terms or changes in the policy to ensure you fully understand the coverage.

Understanding Policy Amendments and Endorsements

Policy amendments and endorsements are changes or additions made to a commercial auto insurance policy that can impact the coverage, terms, and conditions of the policy. These modifications are crucial as they help tailor the policy to better suit the specific needs of fleet owners.

Common Endorsements for Fleet Owners

Endorsements are additional provisions added to the policy to provide extra coverage or modify existing coverage. Here are some common endorsements that fleet owners may need to consider:

- Additional Insured Endorsement: This allows other parties to be covered under the policy, such as lessors or subcontractors.

- Hired Auto and Non-Owned Auto Liability: Extends coverage to vehicles not owned by the company but used for business purposes.

- Motor Truck Cargo Insurance: Protects the goods being transported by the fleet.

- Rental Reimbursement: Covers the cost of renting a replacement vehicle if one of the fleet vehicles is out of commission due to an accident.

Adding or Removing Endorsements

During the policy renewal period, fleet owners have the flexibility to add or remove endorsements to better align the policy with their current needs. This is a great opportunity to reassess the coverage requirements and make adjustments accordingly.

Final Summary

In conclusion, the Commercial Auto Policy Renewal Guide for Fleet Owners equips fleet owners with the knowledge and tools necessary to navigate the complex world of policy renewals. By following the tips and guidelines Artikeld in this guide, fleet owners can effectively manage their commercial auto policies and optimize their coverage for the future.

Q&A

What is a commercial auto policy renewal?

A commercial auto policy renewal is the process by which fleet owners extend or update their existing insurance coverage for their vehicles.

How can fleet owners lower renewal costs?

Fleet owners can lower renewal costs by bundling insurance policies, implementing risk management practices, and negotiating with insurance providers for better rates.

What are policy endorsements?

Policy endorsements are additions or modifications to a standard insurance policy that provide additional coverage or change existing terms.